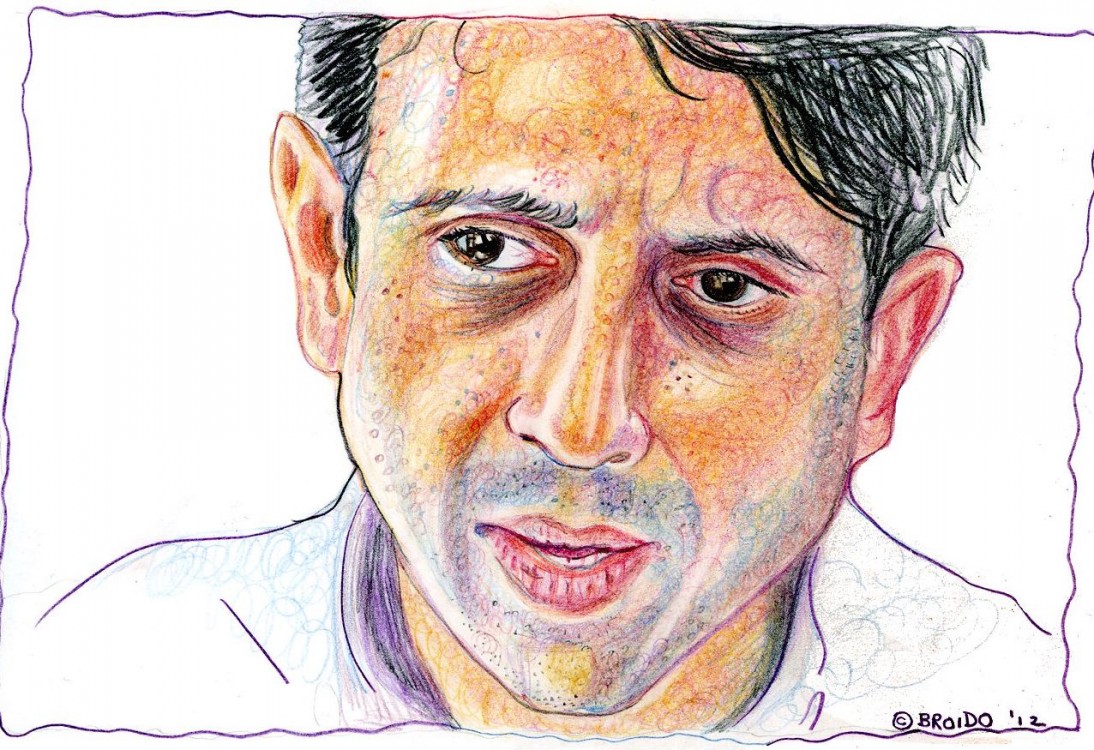

King of Corporate Handouts: How Governor Bobby Jindal Ransacked Louisiana

King of Corporate Handouts: How Governor Bobby Jindal Ransacked LouisianaBobby Jindal is one of America’s worst governors. Since taking office in 2008, Louisiana’s governor has steadily driven the state into a deeper financial hole while handing off an astonishing amount of taxpayer money to already profitable corporations. His entry into the contest for the 2016 Republican presidential race is curious since he obviously won’t be able to run on his own leadership record.

In his two terms, Gov. Jindal has given $11 billion of public money in the form of taxpayer subsidies to multinational corporations – more than any other state – costing the average resident there $2,500. As Mark Provost reported for ATTN.com in February, oil giant ExxonMobil his received $263 million under Jindal's tenure, while other oil companies like Valero and Cleco received $315 million and $180 million, respectively.

This contrasts with Jindal's record on cuts to public education. In January, Jindal proposed slashing $300 million from state colleges and universities. This is on top of the $673 million Jindal cut from college education since he took office – amounting to a net tuition increase of 52.1 percent between 2008 and 2014, or $5,000 for each student.

Under the Jindal administration, Louisiana has become a tax haven for industries ranging from fracking to film production to oil extraction. Since 2008, fracking companies have cost Louisiana $1.2 billion in tax dollars thanks to a horizontal drilling exemption he enabled. Duck Dynasty gets $330,000 in taxpayer dollars for every episodes that run. Two Walmart stores built in wealthy Louisiana suburbs sucked up $700,000 in tax dollars through a program designed to encourage businesses to open new locations in economically-depressed areas.

But Gov. Jindal didn't stop there. He gave $10 million in taxpayer handouts to Valero for an expansion that created 43 jobs, despite Valero pulling in $6 billion in 2013 profits. Under Jindal's reign, the state has increased the amount of handouts in six major corporate tax credit programs by $650 million. As a result of Gov. Jindal’s wanton corporate subsidies and tax cuts for the rich, Louisiana’s legislature just had to balance a $1.4 billion revenue shortfall while state tax revenues are at their lowest in recent history.

But despite such extravagant giveaways for major corporations, job growth has yet to materialize. According to a study by Pew, Louisiana ranks 35th in job growth since the lowest point of the Great Recession, having added only 109,700 jobs since February 2010. As Gordon Russell of the Baton Rouge Advocate reported, Louisiana is paying out millions of dollars in corporate tax breaks for every job created.

An example: Jindal signed off on $1.6 billion in property tax cuts for the oil and gas company Cheniere Energy, along with $117 million in workforce training and payroll costs. For all that cash, Cheniere is only providing an estimated 150 new jobs that pay $100,000 annually, amounting to $7.5 million in public money for each new job.

All of these tax handouts to big business have resulted in a deadly cost to public services across the state. As the New Orleans Times-Picayune reported, Jindal’s proposed $300 million cut for the state’s public universities would have decimated roughly one-third of Louisiana State University’s total pool of funding, including state and federal funding along with money collected from tuition. That amount of money is also nearly identical to the total 2014-2015 cost of the Louisiana Community and Technical College System.

Had those cuts gone through, state colleges and universities would have had to severely cut jobs and curriculum. Jindal, who is now in the lame duck stage of his tenure, told state lawmakers he wanted to avoid higher education cuts, but promised to veto any budget that raised taxes.

While Gov. Jindal prepares for the first round of the Republican presidential debates, his primary concern hasn't been raising revenue to offset the tremendous cuts to state agencies, but rather keeping the “no new taxes” pledge he signed with Grover Norquist’s Americans for Tax Reform, thus boosting his credentials with potential primary voters. The only way the legislature managed to stave off Jindal’s proposed cuts to higher education was to create a phantom tax credit for college students to be routed back through the state treasury. Even Louisiana Republicans called it “money laundering”.

In true Republican presidential candidate fashion, Gov. Jindal turned the Affordable Care Act’s expansion of state Medicaid services into a political crusade. Along with multiple Republican governors around the country, Jindal refused to expand Medicaid in his state – which happens to be one of the poorest – denying health coverage to 193,000 Louisiana residents. In addition to denying health insurance to low-income working families, Gov. Jindal’s blocking of Medicaid expansion led to the closure of the Baton Rouge General Medical Center-Mid City emergency room. This means thousands of Baton Rouge residents are now a 30-minute drive from the nearest emergency room, putting that many more people at risk of serious injury or death due to lack of even the most basic healthcare access.

Bobby Jindal’s two terms as governor should be seen as notes for anyone wanting to know what happens if a recklessly pro-business politician is allowed to experiment freely with a state’s budget for eight years. Louisiana is proof that slashing public programs like education to pay for billions of dollars in handouts to “job creators” doesn’t rejuvenate an economy, but depresses it. Jindal’s run for the White House will be short-lived, since his record as governor shows not a public servant dedicated to the well-being of his constituents, but a craven politician who created a crisis in the name of political expediency to pass off to his unlucky successor.

Under the Jindal administration, Louisiana has become a tax haven for industries ranging from fracking to film production to oil extraction – while instituting cuts to public education and driving the state into a financial hole.

Congress, on July 21, 2010, gave the Securities and Exchange Commission 270 days to issue a rule on how exactly to implement Section 1504 of the Dodd-Frank act – and today, 1,821 days later, there still is no rule.

The leak, which was discovered Wednesday afternoon, is the largest pipeline spill in Alberta in 35 years.

The U.K. government has increased support for the private sector benefiting corporations – not the people who need it.

From Madrid and Barcelona to Zaragoza, A Coruña, Cádiz and other major Spanish cities, government is now in the hands of independent citizen fronts called “confluences” – revealing a seismic shakeup in European politics.

A series of tax breaks enacted in Congress shielded the profits of U.S. corporations operating on the island – and when a crucial tax credit ended 10 years ago, it plunged Puerto Rico into a recession that led to today's crisis.

Email content is easily accessible to many civil and law enforcement agencies as soon as it is at least 180 days old.

This week, we visit Greece, Congress and ALEC

The U.K. government has increased support for the private sector benefiting corporations – not the people who need it.

Email content is easily accessible to many civil and law enforcement agencies as soon as it is at least 180 days old.

-- Delivered by Feed43 service

Post a Comment