With the moratorium on student loan payments set to end with the summer, the American media is once again reckoning with the fact that the US has a hidden crisis with older borrowers weighed down by student debt. In many cases, these borrowers have been paying off student loans for decades.

At the very least, it’s a depressing image of what might lie in store for millions of millennials, as individual student debt burdens have only grown more unmanageable as the cost of college accelerated beyond all control.

But with President Biden considering forgiving $10K per borrower, and the aggregate sum of delinquent student loan debt surpassing $435 billion (roughly one-third of the $1.7 trillion total), it’s important to remember that repaying debt doesn’t get any easier once borrowers pass their prime employment years. In fact, it gets much more difficult once you start living on a fixed income.

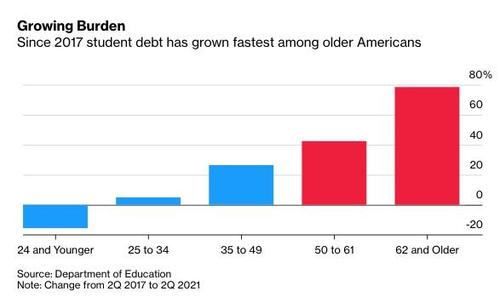

There are now about 8.7 million Americans aged over 50 who are still paying off college loans, and their debt has increased by about half since 2017. Since then, they’ve represented the fastest growing group of borrowers as more older workers have gone back to school to try and change careers.

For worried borrowers looking for relief, they can perhaps rest easy knowing that there’s strength in numbers. With more than 40MM borrowers in the US, student-loan debtors represent a critical voting bloc, which is one of the reasons why investment banks like Goldman see smaller scale debt-relief as the most likely scenario.

But for many, 10K might only make a small dent in what they owe.

It’s also worth considering that some of these borrowers took out loans on behalf of their children. Some took out loans to help their children, and could be well into their 90s before they’re done repaying them. Others went back to school later in life. In both cases, borrowers got saddled with hefty interest rates that caused their balances to balloon over time.

“The interest accrued big-time,” says Alma Topete, 60, who borrowed about $30,000 and owes $70,000 today. “I never expected to have to have a loan at this age.”

And let’s not forget, student loans were never supposed to be a lifelong burden. While some borrowers did it on behalf of their children, others accrued debt from going back to school or getting an expensive graduate degree later in life. That’s why the upcoming unfreezing of debt payments is a multi-generational problem. With payments due to start again in September, consumers (many of whom are just transitioning back into the labor market) will be squeezed by rising prices and the resumption of a bill that typically costs hundreds of dollars per month.

Most student loans are supposed to be repaid on a 10-year clock. But many borrowers, especially those with lower credit, face higher interest rates that make it difficult for them to make much progress on the principle.

But the reality for many borrowers is very different. Frank Sizer Jr., who’s 77, reckons he has nearly two decades of payments still to go. A former prison warden, Sizer borrowed money to help his son study biology at Bridgewater College in Virginia. He retired in 2010 — two years after his son graduated — and currently owes about $52,000.

“God knows what the original amount was,” he says. “It just continued to grow.” He expected to have paid it off before retiring, and it’s only gotten harder to find the $500 a month for loan payments because “you don’t have the income that you did when you were working.”

One reason why parent borrowers like Sizer often find their loan balances swelling is that they have to pay higher interest rates.

Since mid-2006, federally backed loans under the Parent PLUS program have charged an average of 466 basis points above U.S. Treasury bonds, well above the typical rate for student borrowers. And loans to parents come with a hefty one-time origination fee too. The current going rate is 4.23% of the total amount borrowed — about four times what students are typically charged.

It’s not just parental borrowers who suffer from ballooning loan balances late in life.

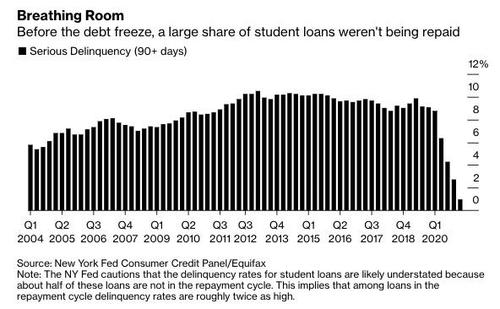

Even before the pandemic, the share of loans in serious delinquency has been stubbornly high.

And senior borrowers represent one in every 10 seriously delinquent borrower.

In its piece, Bloomberg cited the Villages, a popular retirement community in Florida, as an example of growing debt among the elderly.

In The Villages, for example, a vast age-restricted community in central Florida, the median loan balance rose to $17,921 at the end of 2019, from $11,110 a decade earlier. Before the pandemic forbearance, one in eight borrowers there was severely delinquent, according to the Philadelphia Fed’s Consumer Credit Explorer.

When payments fall due again on Oct. 1, more may struggle to pay. It’s not clear if the government will have taken any steps toward debt writedowns by then.

So, now the big question for millions of borrowers is: how much longer until Papa Biden comes charging to the rescue with his oft-promised student-loan debt jubilee?

Harrison sees a two class system devised around crippling debt in our future.

source https://www.infowars.com/posts/a-lifetime-in-debt-older-americans-are-facing-a-student-loan-crisis

Post a Comment